XRP Price Prediction: Navigating Correction and Continuation Patterns

#XRP

- Technical indicators show XRP testing crucial support at $2.79 with mixed momentum signals

- Regulatory delays for XRP ETF create uncertainty while product adoption shows strength

- Price trajectory depends on holding key support and resolving regulatory overhangs

XRP Price Prediction

Technical Analysis: XRP Shows Mixed Signals Near Key Support Level

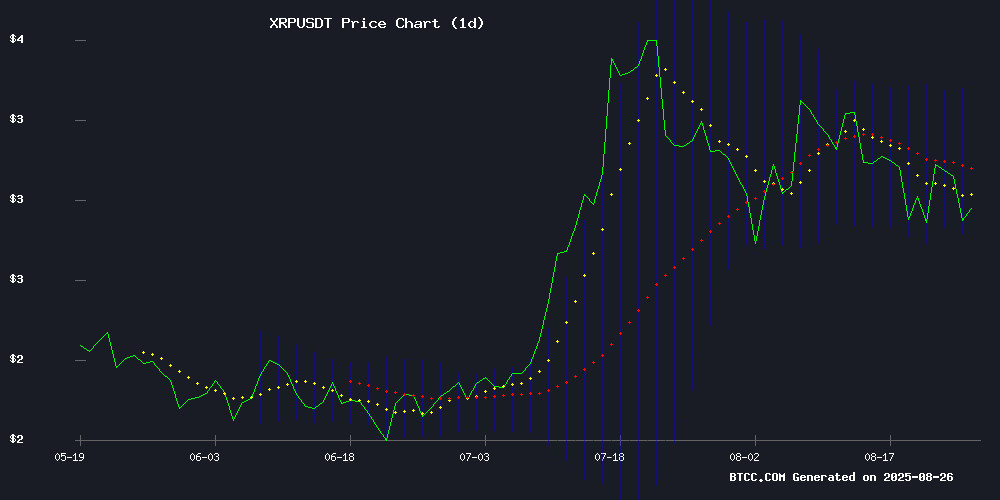

XRP is currently trading at $2.90, below its 20-day moving average of $3.08, indicating short-term bearish pressure. The MACD reading of 0.1310 remains above the signal line at 0.0672, suggesting potential upward momentum despite recent declines. According to BTCC financial analyst John, 'The price is testing the lower Bollinger Band at $2.79, which often serves as a support level. A bounce from this zone could target the middle band at $3.08, while a break below might lead to further downside toward $2.60.'

Market Sentiment: Regulatory Delays Offset by Product Innovation

Recent news presents a balanced outlook for XRP. The SEC's delay on WisdomTree's XRP ETF until October creates regulatory uncertainty, while Gemini's XRP credit card launch and rising app rankings demonstrate growing adoption. BTCC financial analyst John notes, 'The combination of regulatory hurdles and innovative product launches creates a tug-of-war scenario. The market is closely watching whether adoption momentum can overcome regulatory headwinds in the coming months.'

Factors Influencing XRP's Price

AI Perspectives on XRP's 2025 Trajectory: Correction or Continuation?

XRP's 2025 performance has become a focal point for crypto analysts after a volatile first half. The digital asset surged past its 2018 all-time high of $3.40 in January, corrected through spring, then established a new record at $3.65 in July. Current trading below the psychologically important $3 level raises questions about its near-term potential.

Three prominent AI platforms—ChatGPT, Grok, and Gemini—offer divergent readings on XRP's technical positioning. Market observers note the $3 level's transformation from resistance to support and back again suggests critical momentum shifts. The token's earlier breakout coincided with political developments during the 2024 U.S. election cycle, demonstrating its sensitivity to macroeconomic catalysts.

Technical charts reveal XRP spent months range-bound between $0.30-$0.60 before its election-fueled ascent. While some algorithms anticipate consolidation before renewed upside, others flag potential weakness if the $3 floor fails to hold. The coming months may determine whether July's peak marks a cyclical top or a stepping stone to higher valuations.

XRP Price Dips Amid Increased Trading Volume as Market Watches for Next Move

Ripple's XRP slipped 1.58% to $2.90 on Tuesday, retreating from $2.95 despite a 1.82% surge in 24-hour trading volume to $7.18 billion. The divergence suggests active repositioning by traders ahead of potential price action, even as the token maintains a 3.28% weekly gain.

Market capitalization now stands at $172.79 billion, reinforcing XRP's position among top cryptocurrencies. Meanwhile, Cronos, UNUS SED LEO and Four led gainers in the past day, while Fartcoin and Chainlink joined the laggards.

Exchange flows indicate speculative interest building around XRP's next directional move. The volume spike during price weakness typically signals either profit-taking or accumulation - a tension that often precedes volatility.

Gemini Overtakes Coinbase in App Store Rankings Following XRP Credit Card Launch

Gemini's strategic introduction of a limited-edition metal credit card offering 4% back in XRP rewards has propelled its mobile app past Coinbase in Apple's App Store finance rankings. The exchange surged from 117th to 16th place within weeks, while Coinbase slid from 26th to 20th despite maintaining significantly higher trading volumes.

The divergence between app popularity and trading activity highlights shifting user engagement dynamics. Sensor Tower data reveals Gemini's download velocity and retention rates outpaced its larger competitor after the August 6 announcement, with co-founder Tyler Winklevoss touting "the flippening" in market positioning.

Ripple Labs' partnership proved catalytic, generating substantial social media buzz across crypto communities. The metal card's XRP rewards structure appears to have resonated more powerfully than Coinbase's established market presence, where $4.54 billion in daily volume dwarfs Gemini's $382.49 million.

Gemini's XRP Credit Card Fuels Ripple's $5 Ambitions Amid Short-Term Volatility

Ripple's XRP faces conflicting signals as whale activity threatens a near-term pullback to $2.80-$3.00, while Gemini's new crypto credit card injects long-term bullish momentum. The partnership enables cardholders to earn up to 4% XRP rewards on everyday purchases, with select merchants offering 10% returns—a strategic MOVE to embed the token in mainstream finance.

Tyler Winklevoss positions the card as both loyalty badge and utility vehicle, while Ripple CEO Brad Garlinghouse emphasizes bridging crypto with daily commerce. Despite exchange inflow pressures, the $5 price target remains viable given sustained institutional adoption and consumer-facing use cases.

SEC Delays Decision on WisdomTree’s XRP ETF, Pushes Deadline to October

The U.S. Securities and Exchange Commission has extended its review period for WisdomTree’s proposed XRP ETF, setting a new decision date for October 24. The delay affects multiple pending spot XRP ETF applications, with Franklin Templeton’s filing remaining on track for a potential November decision.

Market analysts anticipate a coordinated approval of XRP ETFs later this year, mirroring the SEC’s approach to Bitcoin and ethereum products. Bloomberg Intelligence analysts assign a 95% probability of approval by year-end, following recent amendments to S-1 filings by six asset managers.

Grayscale’s revised registration statement for its XRP Trust ETF suggests active engagement with regulatory feedback. The coming weeks will prove critical as the SEC faces a series of deadlines, beginning with Grayscale’s October 18 review date.

Can XRP Hit $4 By October? Regulatory Clarity and ETF Approvals in Focus

XRP's trajectory toward $4 by October hinges on regulatory developments and potential ETF approvals. The cryptocurrency surged to a 52-week high of $3.65 in mid-July but has since retreated below $3, reflecting the volatility endemic to crypto markets.

Ripple's recent settlement with the SEC and the Trump administration's pro-crypto stance initially signaled regulatory clarity, buoying Optimism for XRP's adoption. However, the SEC's delay in approving spot XRP ETFs—now deferred to mid-October—has tempered momentum. Approval could reignite bullish sentiment, unlocking institutional demand.

The market now watches for two catalysts: regulatory greenlights for stalled blockchain initiatives and ETF decisions. Without these, XRP may struggle to reclaim its July highs.

XRP at a Crossroads: Whale Activity Signals a Critical Price Test Ahead

XRP faces mounting pressure as its price struggles to stabilize, trading near $2.96 amid a mixed broader market. While Ethereum and other assets post gains, XRP has seen a 10% decline over the past month, prompting scrutiny from investors.

Analysts point to significant exchange inflows from large holders as a key factor. PelinayPA of CryptoQuant notes that similar patterns preceded previous cycle tops, including the 2018 peak above $3 and the 2021 high NEAR $1.90. The current inflow activity suggests profit-taking could prolong the correction.

The token's early-2025 rally to $3.5-$4 now appears distant, with whale movements dictating short-term momentum. Market participants await signs of stabilization or further downside as XRP tests critical support levels.

XRP Price Correction Deepens Amid Failed Rally Attempt

XRP's recovery momentum faltered sharply after rejection at the $3.12 resistance level, with the digital asset now trading below key psychological support at $3.00. The breakdown follows a failed attempt to sustain gains above $3.05 during Tuesday's trading session, mirroring broader weakness across major cryptocurrencies including Bitcoin and Ethereum.

Technical indicators turned bearish after XRP/USD broke below an ascending channel on Kraken's hourly chart, with the pair subsequently testing support near $2.82. The current price sits below both the $2.95 level and the 100-hour moving average—a concerning development for bulls. Market participants are watching the $2.98 resistance level, which coincides with the 50% Fibonacci retracement of the recent decline.

XRP Ledger’s First File Storage Testnet Nears Launch with Compliance Focus

The XRP Ledger is poised to introduce its first Immutable file storage service, with a minimum viable product testnet expected within two months. Developer "Vincent Van Code" has expanded the project's scope from simple document notarization to a globally mirrored archive system that integrates with existing crypto wallets.

Originally conceived as a notarization tool for legal documentation, the service now targets enterprise compliance needs before expanding to consumer applications. The system anchors file hashes on-chain while maintaining off-chain storage, creating court-admissible evidence bundles with cryptographic verification.

Pricing will follow a tiered model ranging from free basic services to KYC-verified premium offerings. This development marks XRPL's first foray into decentralized file storage, positioning it against established blockchain storage networks while leveraging its existing payments infrastructure.

How High Will XRP Price Go?

Based on current technical indicators and market developments, XRP faces both opportunities and challenges. The immediate resistance sits at the 20-day MA of $3.08, with stronger resistance at the upper Bollinger Band of $3.37. On the upside, if regulatory clarity emerges and ETF approvals progress, XRP could potentially reach $4 by October. However, failure to hold the $2.79 support could see prices retreat toward $2.60.

| Scenario | Target Price | Timeframe |

|---|---|---|

| Bullish (ETF approval + adoption growth) | $4.00+ | October 2025 |

| Neutral (current range continuation) | $3.00-$3.50 | Next 4-6 weeks |

| Bearish (support break) | $2.60-$2.80 | Short-term |